LEADING EXPERTISE IN FINANCE AND IT!

Clara Financial Consulting is an independent consulting company with a full focus on helping players in the financial industry with both specialist expertise and larger projects.

We help our customers across a broad spectrum of services such as resource reinforcement, expertise, system management, investigations, implementations, procurements, strategic issues or change journeys.

Clara has become known for her ability to quickly understand customers’ needs and deliver solutions and expertise with broad and deep competence in both Finance and IT.

Founded in 2017, Clara has over the years attracted sharp junior and senior employees who have gathered around a vision of how a modern, curious and open consulting company characterized by job satisfaction and continuous learning should function. Today, Clara is a stable partner-owned company with a steady growth of consultants and clients.

WE KNOW IT AND FINANCE

Clara has a wide range of expertise in Finance and IT and our consultants include both recent graduates from the country's leading universities and experienced senior consultants with over 20 years of work experience. We work at the interface between Finance and IT with system support and processes mainly within asset management. We help our customers with everything from development and change of business processes and operations to requirements setting, design, development and management of system solutions.

WHAT CUSTOMERS SAY ABOUT US AT CLARA

Our customers appreciate our dual expertise in both Finance and IT, where we can demonstrate both breadth and depth in our consultants in both areas. When we talk to our customers, we understand their needs quickly, we know what questions need to be asked, and we dare to engage in dialogue with the customer if we notice that the customer has the wrong expectations or that there are gaps in the needs formulation.

We quickly get into our assignments and our consultants can often become productive with customers from day one. By being niche, our consultants have built up a bank of experience from similar needs and issues in the industry, and can use this to contribute best practices and expertise in skills transfer to our customers without keeping the knowledge to ourselves. At Clara, we like to share our skills!

In larger projects, we can dynamically adjust the resources we contribute based on the level of activity during the project, and thanks to our large network of contacts in the industry, we can quickly bring in appropriate resources when unexpected resource peaks and skills gaps arise in the projects.

We take overall responsibility for the delivery and together with the customer we make sure not to lose the overall picture of the project while solving details and ensuring that the needs are transformed into functional and well-tested solutions. We understand the complicated language used by system suppliers both in terms of technology & function. We are happy to discuss and collaborate with the customer’s system suppliers while also having experience in procurement and supplier negotiations if required in the projects.

CUSTOMER CASE

- How Clara Financial Consulting has helped asset managers improve their reporting process

Over the years, Clara Financial Consulting has helped many players in the financial industry improve their reporting system support. With the consultants’ cutting-edge expertise, they can offer both comprehensive solutions and upgrades of existing systems to create winning concepts for their customers – and thus also for their customers’ customers. With her extensive experience, Clara has over the years set a best practice for system support and reporting that they use in their customer projects – and with very good results.

– The core of a good reporting system is to give the user control over what happens in the system while at the same time the process is highly automated. This applies regardless of whether it is customer reporting, legal reporting or internal reporting for follow-up, says Henrik Linné, managing partner at Clara Consulting and continues:

– Our customers are demanding reporting solutions that make their work easier, while at the same time wanting to offer their customers informative and attractive reports that are a cut above the competition. Reliable data quality is very important; no one wants to report incorrect figures to customers or the market that then need to be corrected. Incorrectly reported data to authorities can quickly result in fines of millions. There is therefore both a major reputational and monetary risk if you, as an asset manager, do not have a good grasp of your output data.

Experience – a major competitive advantage

One of Clara Consulting’s unique competitive advantages is that they have extensive experience with different types of reporting solutions and have therefore seen many mistakes made in system support. Therefore, they know what should be best practice for a reporting system.

– Even though Clara Consulting is a young company, several of our consultants have worked in the reporting industry for a long time. We usually advocate a structured model that meets certain basic requirements, he says, referring to a proven solution where the different steps in the report flow are separated by “checkpoints” in between.

A complete reporting system should have its own data mart where at least the following process steps are supported and clearly separated:

Importing data

Data should be imported from different heterogeneous data sources and unified into common concepts in the reporting system. In this step, the data is checked for reasonableness, completeness and recognition. A deviation report should be automatically produced with warning flags where reasonableness, completeness and recognition are not met.

Data processing

Often, the reporting system needs to refine the data, for example, calculate different types of key figures based on market data. This is completely OK, but this refinement needs to be well documented and transparent. The reporting manager needs to be aware of the business logic that is then in the system, and which may need maintenance when external factors change.

Data approval

Finally, there should be an approval or publishing step. This is so that it is always crystal clear what data is released to report consumers, when it has happened and who has done it. This data set should be saved as it should always be possible to track which data has been reported historically. Saved data sets also enable additional control functions with comparison of data at different report times in an automated manner.

– A mistake that we sometimes see in reporting solutions is that there is no distinction between calculation logic and report design. Today, many report tools provide opportunities to both design attractive reports and make advanced calculations. If you choose to put calculation logic in a tool that is perhaps primarily created for report design, it is easy to lose control over the business logic that is built under the hood in distributed report templates. It is better to process the data as far as possible before it reaches the design tool, says Henrik Linné.

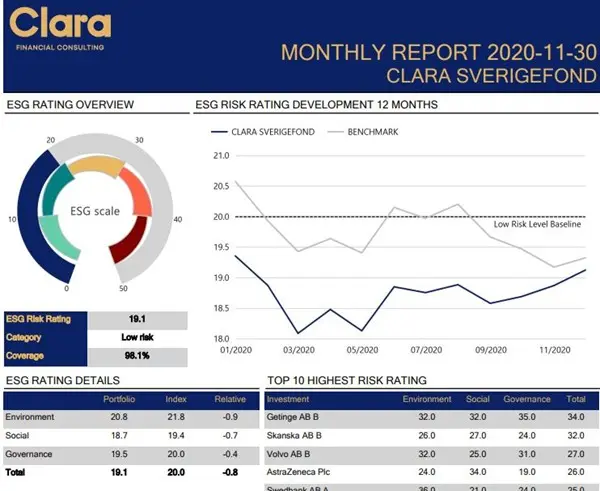

ESG remains hot in the industry - Clara helps clients review their ESG/SFDR reporting

At the moment, many fund companies and asset managers need to supplement their systems with sustainability reporting (ESG), says Henrik Linné.

– It is not only important from a legal perspective but also from a customer perspective. There is hardly any institutional investor anymore that does not include sustainability aspects in their investment policy. Now that additional data is being requested by both the market and authorities, it is an excellent opportunity to review their reporting system as a whole.

TOGETHER WITH HELP TO HELP WE MAKE A DIFFERENCE!

At Clara, we have chosen to allocate a portion of our turnover to support Help to Help's work to enable university education for ambitious students in East Africa, who would otherwise not have the financial means to realize their dreams of an academic degree. Through this initiative, we ensure that young talents have access to education that not only changes their lives, but also contributes to the long-term economic and social development of their home countries.

Through Clara's care, we have over the years had the privilege of financing a number of students' studies in economics, IT and medicine at the University of Dar es Salaam. These studies not only give them the academic knowledge required to understand global development needs, but also the opportunity to contribute to the digitalized and technological development in their home country. In this way, we play a small but important role in building a more sustainable and just future.