Over the years, Clara Financial Consulting has helped many players in the financial industry to improve their reporting system support. With the consultants’ expertise, they are able to offer both complete solutions and upgrades of existing systems to create winning concepts for their clients – and thus also for their clients’ customers. With their solid experience, Clara has over the years set a best practice for system support and reporting that they use in their client projects – and with very good results.

– The essence of a good reporting system is to give the user control over what is happening in the system while keeping the process highly automated. This is true whether it is customer reporting, legal reporting or internal reporting for follow-up, says Henrik Linné, managing partner at Clara Consulting and continues:

– Our clients demand reporting solutions that make their work easier, while at the same time they want to offer their customers information-rich and stylish reports that are far sharper than the competition. Reliable data quality is very important, no one wants to report incorrect figures to customers or the market that then need to be corrected. Incorrectly reported data to authorities can quickly result in millions in fines. So there is both a major reputational and monetary risk if asset managers do not have good control of their output data.

Experience – a major competitive advantage

One of Clara Consulting’s unique competitive advantages is that they have extensive experience with various types of reporting solutions and have therefore seen many mistakes made in system support. Therefore, they know what should be best practice for a reporting system.

– Although Clara Consulting is a young company, several of our consultants have worked in the reporting industry for a long time. We tend to advocate a structured model that meets certain basic requirements,” he says, referring to a proven solution that separates the various steps in the reporting flow with “checkpoints” in between.

A complete reporting system should have its own data mart that at least supports the following process steps and clearly separates them:

1. Import of data

Import of data should be possible from different heterogeneous data sources and unified into common concepts in the reporting system. In this step the reasonableness, completeness and recognition of the data are checked. Deviation report shall be automatically produced with warning flags where reasonableness, completeness and recognition are not met.

2. Data refinement

Often the reporting system needs to refine the data, for example to calculate different types of ratios from market data. This is perfectly OK, but this refinement needs to be well documented and transparent. The reporting officer needs to be aware of the business logic that is then present in the system, which may need to be maintained as environmental factors change.

3. Approval of data

Finally, there should be an approval or publication step. This is so that it is always crystal clear what data is released to report consumers, when it has been released and who has done it. This data set should be kept as it should always be possible to track what data has been reported historically. Saved data sets also allow for additional control functions with comparison of data at different reporting times in an automated way.

– A mistake we sometimes see in reporting solutions is that the computational logic and the report design are not separated. Today, many reporting tools provide the ability to both design beautiful reports as well as perform advanced calculations. Choosing to put computational logic into a tool that may be primarily created for report design, it is easy to lose control of the business logic that is built under the hood of distributed report templates. Better then to process the data as far as possible before it reaches the design tool, says Henrik Linné.

Extended sustainability reporting requirements – timely to review reporting solutions

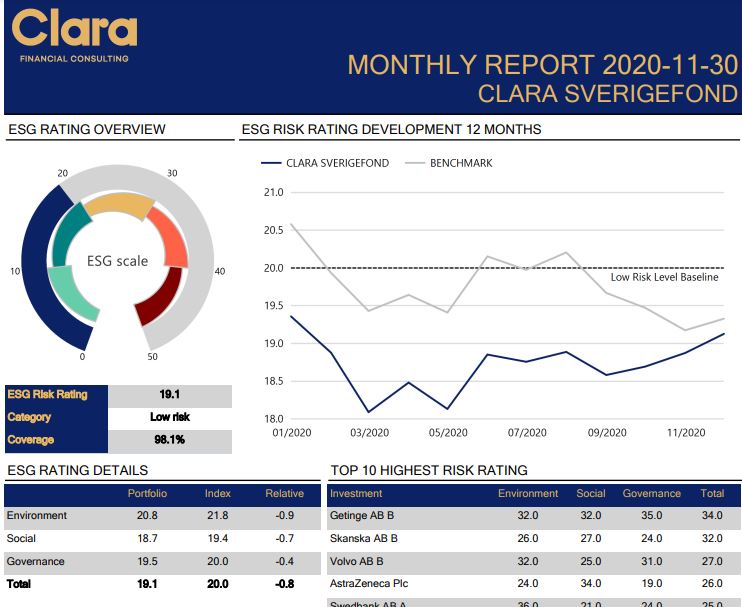

At the moment, many fund companies and asset managers need to supplement their systems with sustainability reporting (ESG), says Henrik Linné.

– It is not only important from a legal perspective, but also from a client perspective. There are hardly any institutional investors anymore who do not include sustainability aspects in their investment policy. Now that additional data is being requested by both the market and the authorities, it is an excellent time to review your reporting system as a whole.